You can have a completely free checking account if you get the right type and are smart about your financial choices. Bank fees are expensive, and even minor monthly charges can add up to hundreds in a year.

It is possible to never pay another bank fee again by making some small changes to your spending. You can even get cashback when you switch to a different bank. The right checking and savings account can even help you get a better handle on your finances.

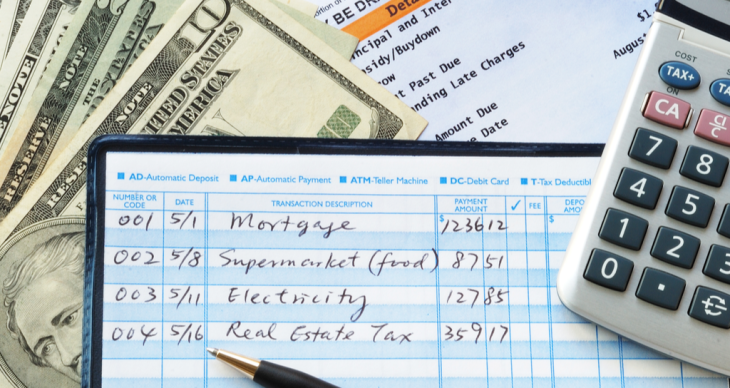

Checking or savings accounts can have associated fees. These charges can include:

· Monthly maintenance charges just for having an account.

· Minimum balance charges for not having sufficient funds.

· An overdraft fee for spending more than what is in your account.

· ATM fees for using machines not affiliated with your bank.

· Foreign transaction charges for using your debit card outside of the country.

· Hard copy statement fees for not opting for the paperless option.

· A replacement debit card fee for a lost or damaged card.

· An inactivity fee for not using your account enough.

· An account closing fee for closing your account before a certain time.

Banks compete with one another for your business and offer free checking and savings accounts to new customers. While you can find many no fee checking accounts, some banks have conditions.

For example, banks will waive monthly maintenance fees for setting up direct deposit or maintaining more than a certain amount. Some requirements you must meet for a free online checking account could include:

· Opening an account by a specific date.

· An initial deposit of more than a certain amount.

· Maintaining a minimum balance for a consecutive number of days.

· Setting up direct deposit with a third-party.

For instance, Chase checking account fees are between $12 and $25 unless you have more than $5,000 to $15,000 in your account (account minimums depend on the account type). The company also waives monthly fees if you have a direct deposit set up with your employer.

You can find a bank account free of monthly fees. However, you might still get a charge for spending more than you have unless you do the following.

By Admin –